In times of economic uncertainty or when you’re saving up for something big, the question isn’t just how to grow your money—but where to park your cash safely.

Whether it’s your emergency fund, a down payment, or just idle savings you don’t want exposed to stock market risk, the top contenders in 2025 are:

- High-yield savings accounts

- Certificates of deposit (CDs)

- I-Bonds

Each option comes with its own pros and cons. Let’s break them down in simple, relatable terms—so you can decide what works best for your situation right now.

Why Cash Parking Matters

When you’re sitting on cash, you want two things:

- Safety

- Some return

You’re not trying to hit a home run. You just want your money to earn something without losing value.

In 2025, with inflation still above historical averages and interest rates holding steady, there are actually solid options to earn 4%–5%+ on your savings—if you know where to look.

Option 1: High-Yield Savings Accounts

These are like regular savings accounts, but they pay significantly more interest. While your local bank might offer 0.01%, high-yield savings accounts from online banks are now paying 4.25% to 5.00% APY.

Why people love them:

- Fully liquid—you can withdraw anytime

- FDIC insured up to $250,000

- No penalties or lock-up periods

Good for:

- Emergency funds

- Short-term goals

- People who value flexibility

Top banks in 2025:

- Ally Bank

- Discover Online Savings

- Marcus by Goldman Sachs

- CIT Bank

Option 2: Certificates of Deposit (CDs)

A CD is like a time-locked savings account. You agree to keep your money in the account for a fixed period (e.g., 6 months, 1 year, 5 years), and in return, the bank pays you a higher interest rate.

Current average rates:

- 6-month CD: ~4.85% APY

- 12-month CD: ~5.15% APY

- 5-year CD: ~4.25% APY

Why people choose CDs:

- Fixed return with no risk

- Higher rates for longer terms

- FDIC insured

Drawbacks:

- Penalties for early withdrawal

- Less flexibility

- Rates are locked in—even if they rise later

Best for:

- Funds you don’t need for a specific period

- People who want a guaranteed, safe return

Option 3: I-Bonds

I-Bonds are U.S. government savings bonds that pay a combination of a fixed rate + an inflation rate that adjusts every 6 months.

In 2025, the fixed rate is 1.30%, and with current inflation rates, total yields are around 4.30% to 5.00%.

Why people love I-Bonds:

- Backed by the U.S. Treasury (very safe)

- Keep pace with inflation

- Interest is tax-deferred until you cash them out

- State and local tax-free

Limitations:

- $10,000 purchase limit per year per person (electronic)

- Must hold for at least 12 months

- Lose 3 months’ interest if cashed out before 5 years

- Can’t be bought through your regular bank—you need a TreasuryDirect.gov account

Best for:

- Long-term savers

- Inflation-conscious investors

- People okay with limited liquidity

Comparison Table: Best Place to Park Cash

| Feature | High-Yield Savings | CDs | I-Bonds |

|---|---|---|---|

| APY (2025) | 4.25%–5.00% | 4.50%–5.15% | 4.30%–5.00% |

| Liquidity | Immediate | Locked for term | Locked 12–60 months |

| FDIC/Backed | Yes (FDIC) | Yes (FDIC) | Yes (U.S. Treasury) |

| Risk | Very low | Very low | Zero risk |

| Best for | Emergency funds, flexibility | Fixed goals | Long-term inflation hedge |

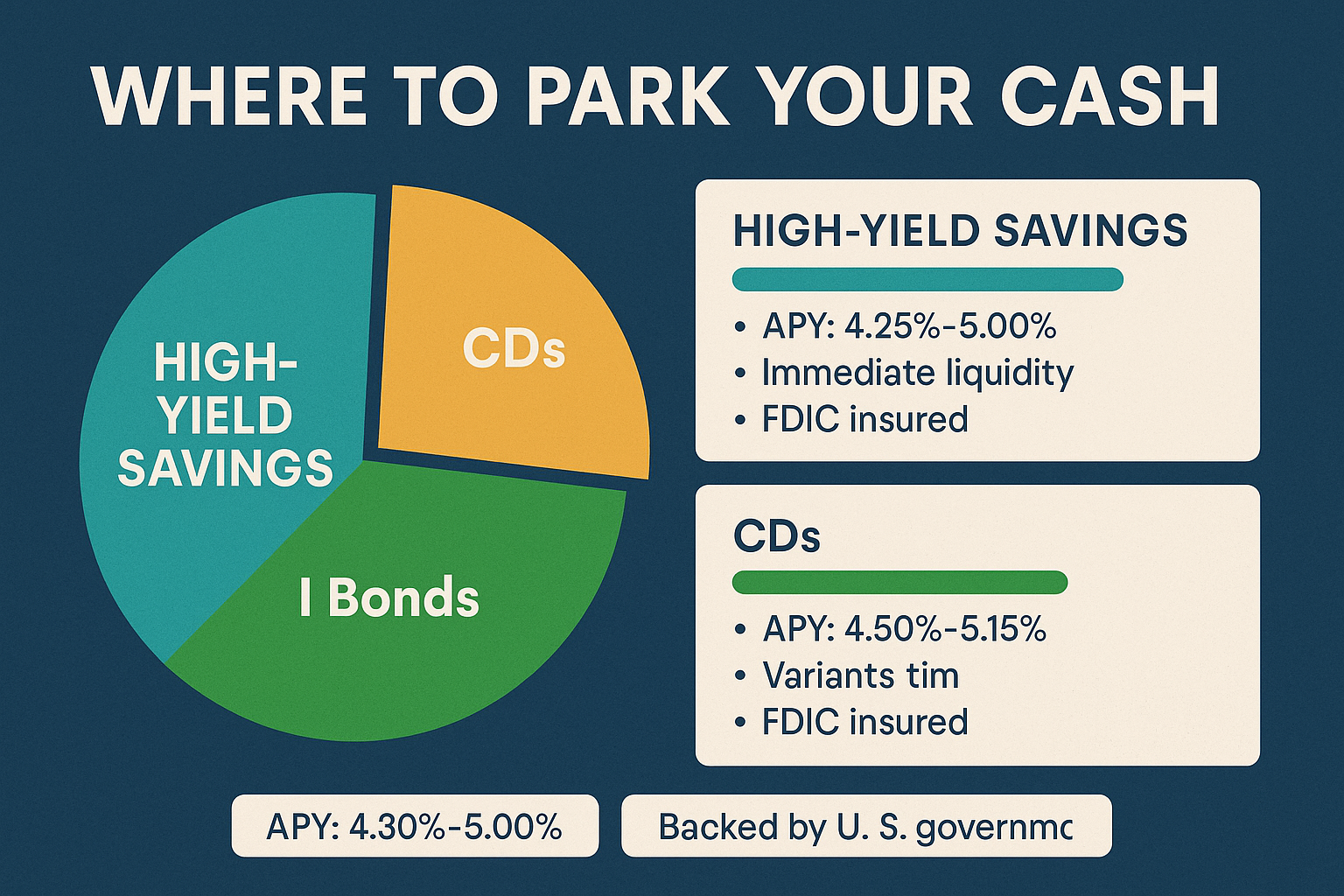

Pie Chart: When to Use Each

Here’s a sample allocation strategy for a $50,000 cash reserve:

- 40% in High-Yield Savings ($20,000) for emergencies

- 35% in 12-month CDs ($17,500) for short-term savings

- 25% in I-Bonds ($12,500) for long-term preservation

This mix balances liquidity, yield, and safety.

How to Decide Where to Park Your Cash

Ask yourself these questions:

How soon will I need the money?

- If it’s within 3–6 months: Go with high-yield savings

- If it’s in 6–24 months: CDs offer better rates

- If it’s in 1–5 years: I-Bonds are a smart hedge

Am I okay with locking the money up?

- No? Stick with savings.

- Yes? Explore CDs and I-Bonds for more return.

Am I worried about inflation?

- If so, I-Bonds are your best friend

Do I want total safety?

- All three options are extremely safe—but only I-Bonds are 100% government-backed

Tips to Maximize Your Returns

- Use multiple accounts: Park emergency money in a high-yield savings account, use a CD ladder for medium-term needs, and I-Bonds for long-term inflation protection.

- Watch rate changes: Online banks change APYs monthly—check back quarterly.

- Consider CD ladders: Split money into 6-month, 12-month, and 18-month CDs. As one matures, reinvest or use it based on your needs.

- Buy I-Bonds early in the month: Interest is credited for the full month, even if purchased on the last day.

Common Mistakes to Avoid

- Keeping large cash balances in regular savings or checking accounts (earning 0.01%)

- Cashing out I-Bonds too early and losing interest

- Locking money into long-term CDs during a rising rate environment

- Overlooking tax implications on interest (except for I-Bonds at the state level)

Final Thoughts

In 2025, you’ve got more cash-earning tools than ever—and they’re safer, smarter, and more accessible than most people realize.

High-yield savings accounts are great for flexible access. CDs reward you for patience. And I-Bonds protect you against inflation with zero risk. The key is to match your strategy with your goals and timeline.

If you’re serious about protecting and growing your savings, don’t let your money sit idle. Park it with purpose.