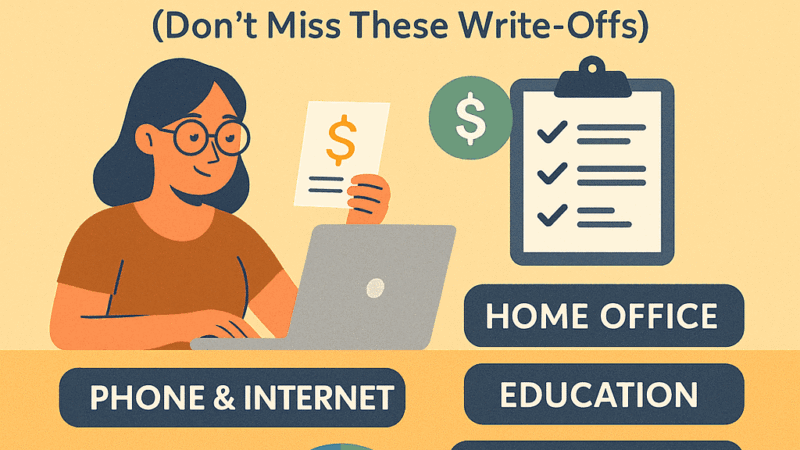

Side hustles aren’t just for extra income anymore—they’re how millions of Americans build businesses, cover bills, and transition to full-time self-employment. But if you’re not claiming your eligible tax write-offs,…

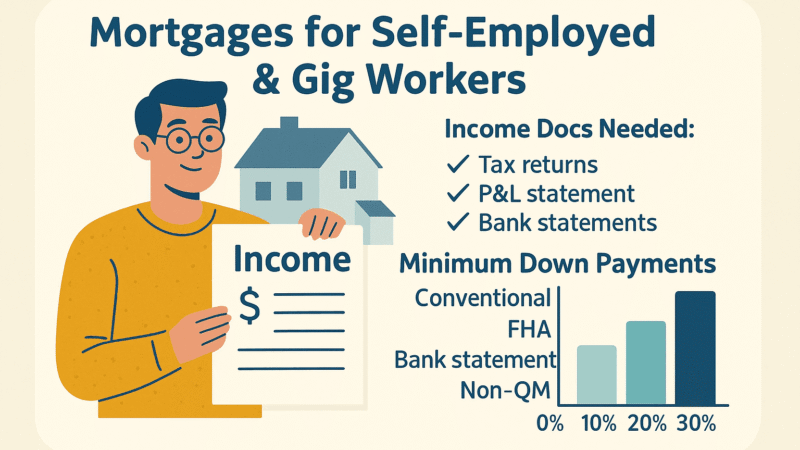

Buying a home has always been a major milestone. But if you’re self-employed or earning your income through gig work, the process can feel a lot more complicated. The rules…

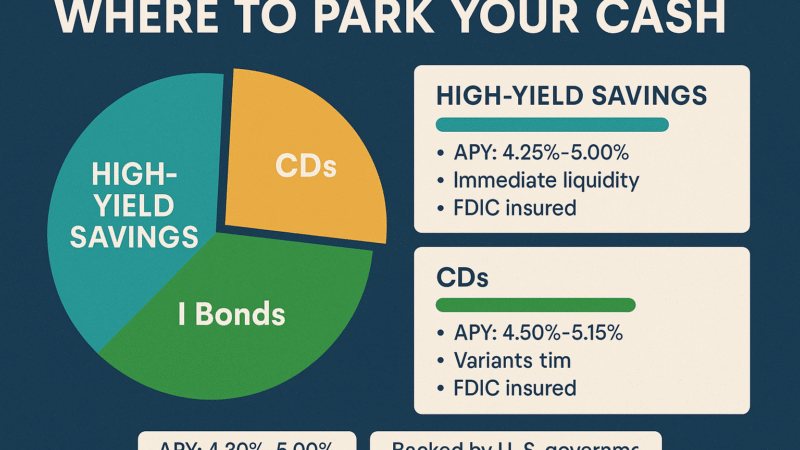

In times of economic uncertainty or when you’re saving up for something big, the question isn’t just how to grow your money—but where to park your cash safely. Whether it’s your emergency fund,…

If you’ve ever wished your money could work for you while you sleep, DeFi and staking for passive income might be your answer—especially in today’s digital economy. Unlike traditional savings accounts offering…

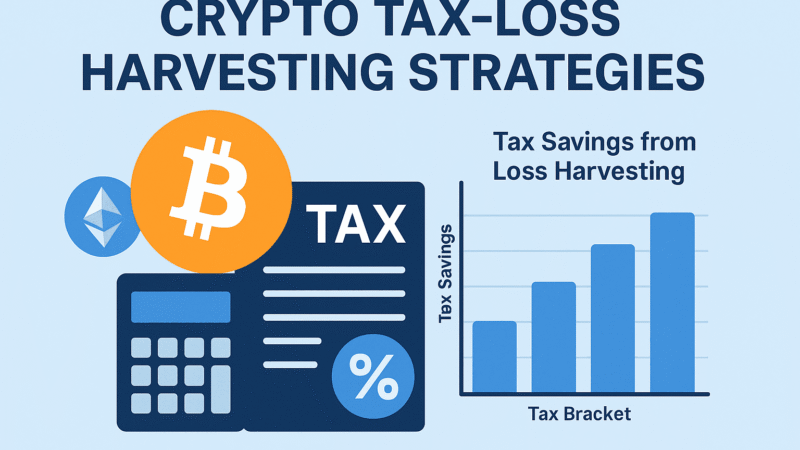

Crypto markets are volatile. You can be up 40% one month and down 60% the next. But believe it or not, that volatility can work in your favor—especially at tax…

When most people think about retirement savings, their minds jump to stocks, bonds, and mutual funds. But in an era of economic uncertainty and currency volatility, many are starting to…

Most people think IRAs are limited to mutual funds and stocks—but they’re not. With a Self-Directed IRA (SDIRA), you can take control of your retirement money and invest in alternative assets…

If you’ve maxed out your regular Roth IRA or 401(k) and still want to stash more into tax-advantaged accounts, the Mega Backdoor Roth IRA is your secret weapon. This advanced strategy allows…

When managing your money, one of the first questions you’ll face is whether to work with a robo-advisor or a human advisor. As AI and automation become more mainstream in finance,…

Living abroad doesn’t mean leaving your financial future behind. In fact, retirement planning for expats requires more strategy than ever—especially as cross-border taxes, healthcare, and currency risks can complicate your path to…