For gig workers and freelancers, one month can feel like a financial windfall—and the next like you’re scrambling just to cover rent. If you’ve ever stressed about how to handle unpredictable paychecks, you’re not alone. In 2025, millions of Americans earn their living through platforms like Uber, Upwork, Fiverr, DoorDash, Etsy, and more. And while the flexibility is empowering, the irregular income can make financial planning feel like walking a tightrope.

But here’s the truth: you can build stability, security, and even long-term wealth—even with inconsistent pay. You just need the right systems.

Let’s break down a practical plan for managing irregular income as a gig worker, freelancer, or solopreneur.

Why Irregular Income Is So Tricky

Traditional employees know what to expect: two paychecks a month, taxes already withheld, and benefits baked in. Gig workers? Not so much.

When you’re self-employed, you’re often juggling:

- Varying monthly income

- No employer health insurance

- Your own tax filings and savings

- Lack of paid time off or sick leave

This means every financial decision has more weight. Miss a few slow months without preparation, and you’re stuck dipping into credit cards or delaying rent.

Step 1: Know Your Monthly Minimums

Start by defining your barebones budget—the absolute minimum you need to survive each month.

Include:

- Rent or mortgage

- Groceries and utilities

- Transportation

- Insurance (health, auto, etc.)

- Loan payments or credit cards

Let’s say that number is $2,700/month. That’s your survival baseline. Now add in “nice to have” extras like dining out, subscriptions, or savings. That gives you your full target budget.

Write down both numbers. You’ll use them to build your income goals and savings plan.

Step 2: Average Out Your Income

Look at the last 6–12 months of income and find your monthly average. If your income looks like this:

| Month | Earnings |

|---|---|

| January | $4,200 |

| February | $2,800 |

| March | $3,600 |

| April | $5,000 |

| May | $3,100 |

| June | $4,400 |

| Average | $3,850 |

Use that average to create a base budget—but prepare to live off less when needed, especially in lean months.

Step 3: Build a “Hustle Buffer” Fund

Think of this as a personal business emergency fund.

Start by saving 1–2 months of living expenses. Over time, build it up to 3–6 months. This way, if you have a bad month—or take a break—you’re not panicking.

Even saving $100/month adds up. Put this in a high-yield savings account to earn interest while it waits.

Step 4: Set Up a Simple System to Track Cash Flow

Use a spreadsheet, app, or accounting software to track:

- Income sources (clients, platforms, tips)

- Business expenses (write-offs!)

- Monthly profit

- Taxes owed

Tools like QuickBooks Self-Employed, Wave, or even Notion templates can make this easy.

Set a calendar reminder to review everything monthly. Knowing your numbers is half the battle.

Step 5: Create a Pay Yourself System

Don’t just spend whatever hits your account. Divide your income into buckets:

- 50% to personal expenses

- 25% to taxes

- 15% to savings

- 10% to business investments

You can adjust these based on your needs, but having a system reduces decision fatigue—and surprise tax bills.

Consider using multiple bank accounts:

- One for everyday expenses

- One for taxes

- One for savings

- One for business income

Apps like Lili, Found, and Novo are built with freelancers in mind and can automate this for you.

Step 6: Save for Taxes Year-Round

Self-employed workers must pay:

- Federal income tax

- Self-employment tax (15.3%)

- State taxes (where applicable)

Use the 25% rule: set aside 25% of your income for taxes. Better to save more and have a refund than come up short.

Also, remember to file quarterly estimated taxes using IRS Form 1040-ES. They’re due in April, June, September, and January.

Step 7: Separate Business and Personal Finances

This isn’t just good practice—it protects you during tax time and audits.

Have a separate debit card, bank account, and maybe even an LLC or sole proprietorship structure (depending on your income level). Keeping clean records makes tax deductions easier to prove—and helps you see how your business is really doing.

Step 8: Use Slow Months to Reinvest

If your work is seasonal or inconsistent, don’t just go into survival mode during quiet months. Instead:

- Learn a new skill

- Build your website or brand

- Network with potential clients

- Review your goals and strategy

Use downtime wisely—it pays dividends.

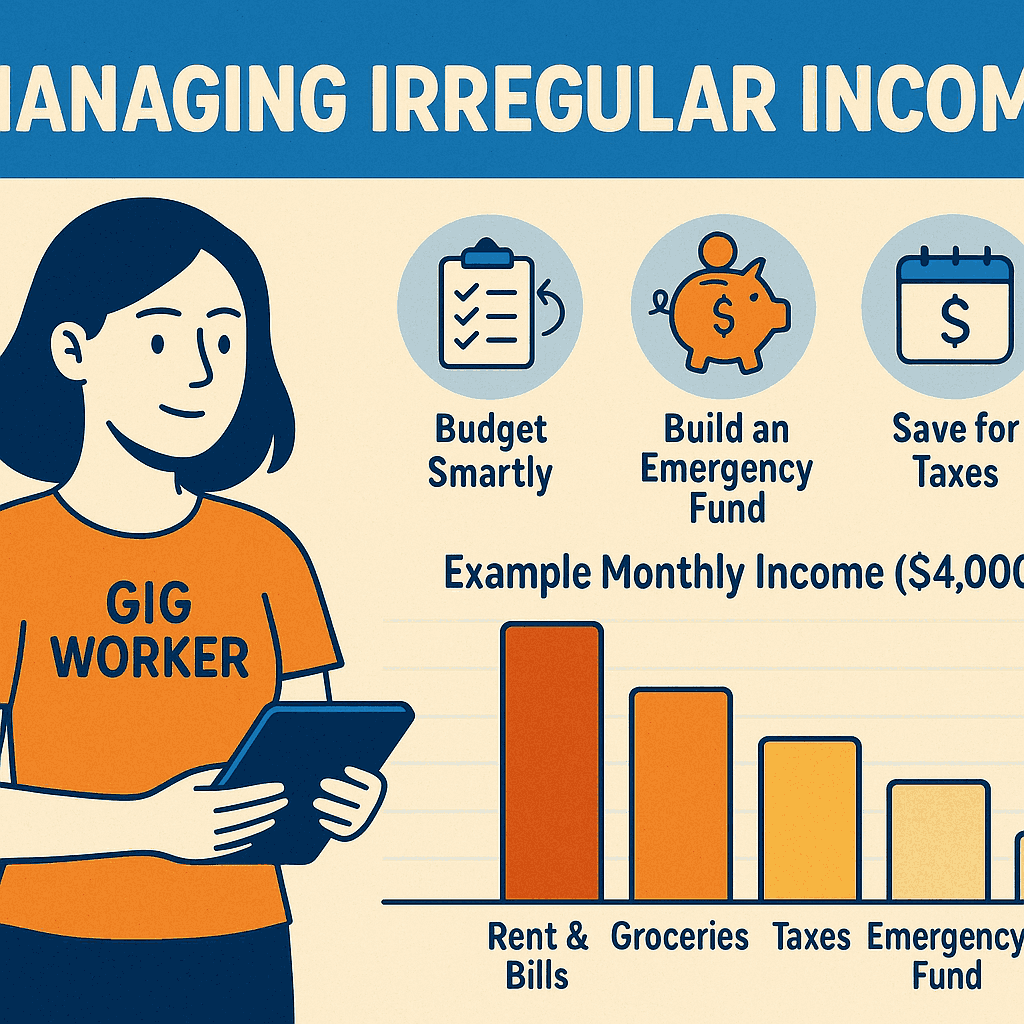

Bar Chart: Example Gig Worker Budget (Monthly $4,000 Income)

| Category | Allocation |

|---|---|

| Rent & Bills | $1,400 |

| Groceries | $500 |

| Transportation | $300 |

| Taxes (saved) | $1,000 |

| Emergency Savings | $300 |

| Business Tools | $200 |

| Personal Spending | $300 |

This structure keeps you afloat—even if next month isn’t as strong.

Bonus: What to Do When Income Drops

If you hit a slow month:

- Tap your hustle buffer before credit cards

- Delay non-urgent purchases

- Reach out to past clients for short-term gigs

- Look for quick-turnaround jobs on platforms like Upwork or TaskRabbit

- Reassess your rates or service offerings

Slow income doesn’t mean you’ve failed. It just means it’s time to pivot, adapt, and refocus.

Final Thoughts

Managing irregular income isn’t about earning more—it’s about building a smarter system for what you already earn.

The key? Think like a business, even if you’re just freelancing part-time. Track your cash, build buffers, and give your money a job before it disappears. With the right setup, you can not only survive the freelance rollercoaster—but thrive on it.